Vital Actions for Effective Credit Repair You Need to Know

Vital Actions for Effective Credit Repair You Need to Know

Blog Article

Recognizing Just How Credit Report Repair Functions to Enhance Your Financial Health

The procedure encompasses identifying errors in credit scores records, contesting mistakes with credit scores bureaus, and discussing with financial institutions to deal with impressive financial obligations. The question remains: what details methods can individuals use to not only remedy their credit scores standing however also make sure long-term economic stability?

What Is Credit Scores Repair Service?

Debt fixing refers to the process of improving an individual's creditworthiness by attending to mistakes on their credit record, working out financial obligations, and taking on better financial habits. This diverse method intends to boost an individual's credit history rating, which is a critical consider securing car loans, debt cards, and desirable rate of interest.

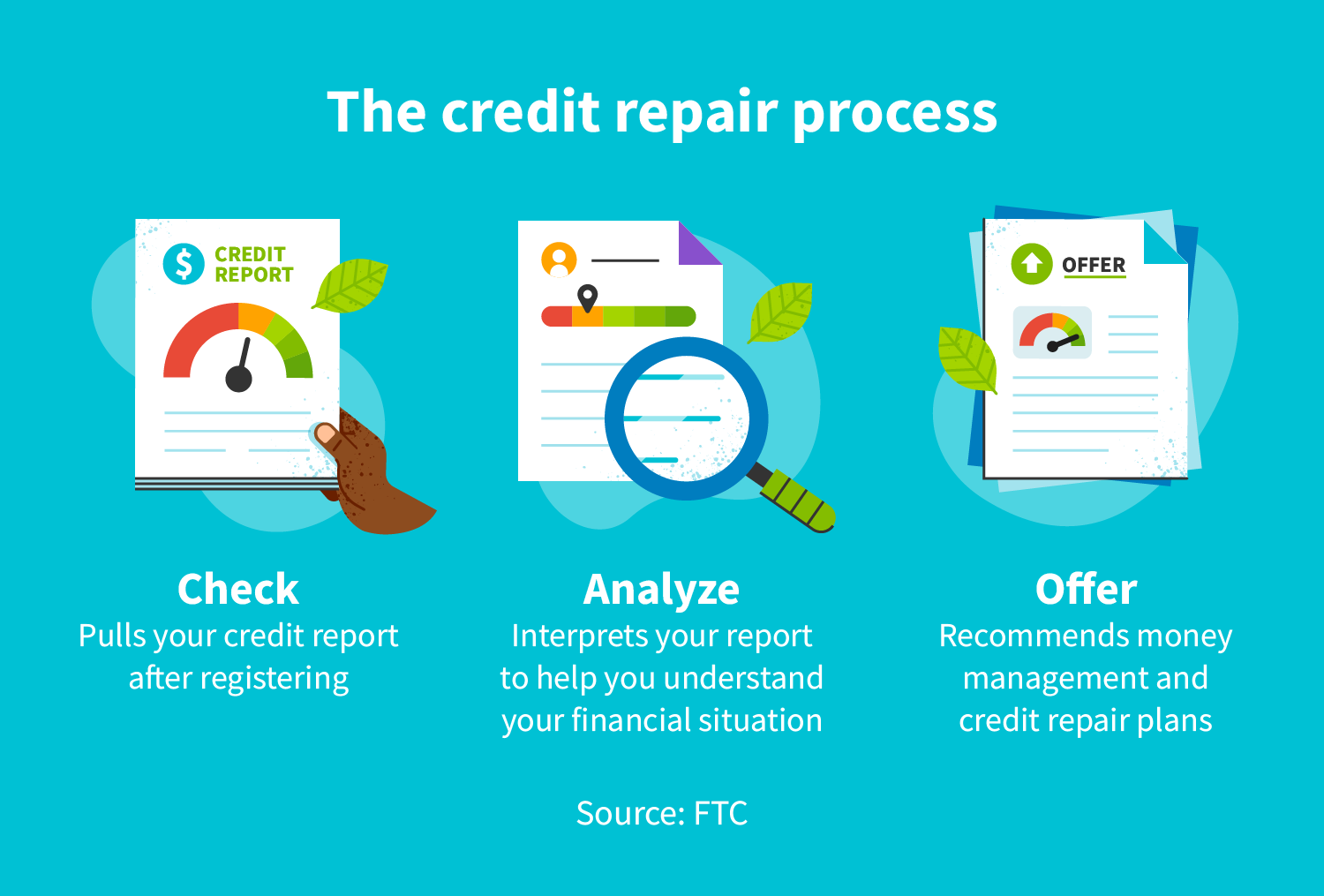

The credit score repair work procedure typically begins with a detailed testimonial of the person's debt report, permitting the identification of any type of mistakes or inconsistencies. As soon as mistakes are identified, the private or a credit repair work specialist can start disputes with credit bureaus to remedy these problems. Furthermore, working out with lenders to clear up impressive financial debts can even more boost one's economic standing.

Additionally, embracing sensible economic techniques, such as prompt expense repayments, decreasing credit history application, and maintaining a diverse credit report mix, adds to a healthier credit history account. Generally, credit fixing works as a necessary method for individuals looking for to reclaim control over their monetary health and protect far better loaning opportunities in the future - Credit Repair. By participating in credit report repair service, people can lead the way towards achieving their economic objectives and boosting their total high quality of life

Usual Credit Report Record Errors

Mistakes on credit report reports can dramatically affect a person's credit report, making it crucial to understand the common sorts of mistakes that may occur. One widespread problem is inaccurate personal info, such as misspelled names, incorrect addresses, or incorrect Social Safety and security numbers. These errors can lead to complication and misreporting of creditworthiness.

One more usual error is the reporting of accounts that do not belong to the person, frequently as a result of identification burglary or clerical blunders. This misallocation can unjustly reduce a person's credit rating rating. Furthermore, late settlements might be erroneously tape-recorded, which can occur because of settlement handling mistakes or inaccurate coverage by lending institutions.

Credit limits and account balances can also be misstated, leading to a distorted sight of a person's credit scores usage ratio. Awareness of these common errors is essential for effective credit score administration and fixing, as addressing them quickly can help people maintain a much healthier monetary profile - Credit Repair.

Actions to Disagreement Inaccuracies

Disputing errors on a credit history record is a vital process that can help restore a person's credit reliability. The very first step includes obtaining a current duplicate of your credit rating report from all three significant credit score bureaus: Experian, TransUnion, and Equifax. Review the report carefully to determine any mistakes, such as inaccurate account details, equilibriums, or payment histories.

When you have identified discrepancies, collect supporting documents that substantiates your claims. This may consist of bank statements, settlement verifications, or communication with creditors. Next, launch the conflict procedure by calling the pertinent credit bureau. You can usually submit disputes online, by means of mail, or by phone. When sending your disagreement, plainly outline the inaccuracies, provide your proof, and include personal recognition information.

After the disagreement is filed, the credit history bureau will explore the claim, generally within 30 days. They will certainly reach out to the financial institution for confirmation. Upon completion of their investigation, the bureau will certainly educate you of the end result. They will correct the record and send you an upgraded copy if the disagreement is resolved in your support. Keeping precise documents throughout this process is important for reliable resolution and tracking your credit rating wellness.

Structure a Strong Credit Report Profile

Building a strong credit scores profile is essential for protecting favorable economic chances. Consistently paying debt card expenses, financings, and other obligations on time is vital, as payment history substantially influences credit score scores.

Moreover, keeping low credit application ratios-- ideally under 30%-- is vital. This means maintaining charge card balances well below their limitations. Expanding credit scores types, such as a mix of rotating credit history (charge card) and installment fundings (automobile or mortgage), can likewise boost debt profiles.

Consistently monitoring credit rating records for errors is similarly vital. People must examine their credit history records at the very least yearly to identify inconsistencies and challenge any type of mistakes immediately. Furthermore, staying clear of excessive credit report inquiries can stop potential negative effect on credit report.

Long-lasting Benefits of Credit Fixing

In addition, a more powerful credit scores account can promote much better terms for insurance premiums and also influence rental applications, making it easier to protect real estate. The mental benefits should not be overlooked; people who successfully repair their credit score typically experience lowered anxiety and boosted confidence in managing their funds.

Conclusion

In verdict, debt repair offers as a vital system for improving monetary health. By determining and challenging inaccuracies in credit scores records, individuals can remedy mistakes that adversely influence their credit report ratings.

The long-term benefits of helpful resources credit rating repair service extend far past just boosted credit score ratings; they can considerably improve a person's overall economic health and wellness.

Report this page